[UPDATE: After reading this post, see here for an updated version of the spreadsheet].

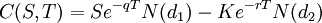

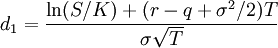

The Black-Scholes option valuation formula for an option paying a continuous dividend yield is the following:

Where

and

Attached is a simple Excel function that calculates the Black-Scholes option value for a specific set of input parameters. Currently, it just calculates the call value – if you use it as an array function, it will return a 4-element array with call value, call delta, put value, put delta, respectively. You could extend it pretty easily to calculate the rest of the Greeks.

Here is the code for the function (To create an Excel function, press ALT-F11 in your workbook and select Insert>Module. Note that the dividend yield parameter is optional.

Function BlackScholes(SpotPrice As Double, ExercisePrice As Double,

TimeToMaturity As Double, RiskFreeRate As Double, sigma As Double,

Optional DividendYield As Double) As Double()

Dim d1 As Double

Dim d2 As Double

Dim Nd1 As Double

Dim Nd2 As Double

Dim ResultArray() As Double

ReDim ResultArray(4) As Double

If (IsMissing(DividendYield)) Then

d1 = WorksheetFunction.Ln(SpotPrice / ExercisePrice) +

((RiskFreeRate + (0.5 * (sigma ^ 2))) * TimeToMaturity)

Else

d1 = WorksheetFunction.Ln(SpotPrice / ExercisePrice) +

((RiskFreeRate - DividendYield + (0.5 * (sigma ^ 2))) * TimeToMaturity)

End If

d1 = d1 / (sigma * (TimeToMaturity ^ (1 / 2)))

d2 = d1 - (sigma * (TimeToMaturity ^ (1 / 2)))

Nd1 = WorksheetFunction.NormSDist(d1)

Nd2 = WorksheetFunction.NormSDist(d2)

'Call Value

If (IsMissing(DividendYield)) Then

ResultArray(0) = (SpotPrice * Nd1)

- (ExercisePrice * Exp(-RiskFreeRate * TimeToMaturity) * Nd2)

Else

ResultArray(0) = Exp(-DividendYield * TimeToMaturity) * (SpotPrice * Nd1)

- (ExercisePrice * Exp(-RiskFreeRate * TimeToMaturity) * Nd2)

End If

'Call Delta

ResultArray(1) = Nd1

'Put Value

If (IsMissing(DividendYield)) Then

ResultArray(2) = Exp(-RiskFreeRate * TimeToMaturity)

* ExercisePrice * (1 - Nd2) - SpotPrice * (1 - Nd1)

Else

ResultArray(2) = Exp(-RiskFreeRate * TimeToMaturity) * ExercisePrice

* WorksheetFunction.NormSDist(-d2) - Exp(-DividendYield * TimeToMaturity)

* SpotPrice * WorksheetFunction.NormSDist(-d1)

End If

'Put delta

ResultArray(3) = -WorksheetFunction.NormSDist(-d1)

BlackScholes = ResultArray

End Function

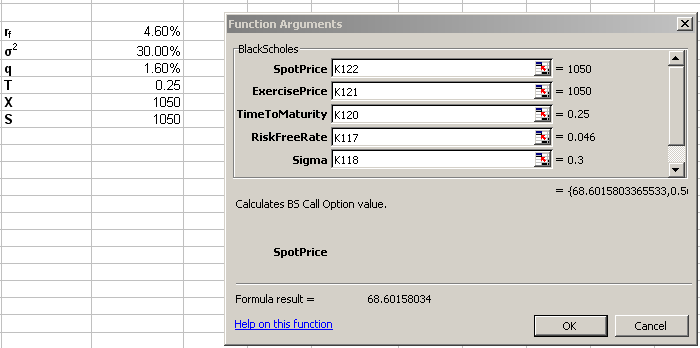

Save this, and set up the input parameters in Excel. Select a range of 4 cells, and then click the f(x) function selection button. Choose from the list of User Defined functions, and then select BlackScholes. Excel will prompt you for the input parameters:

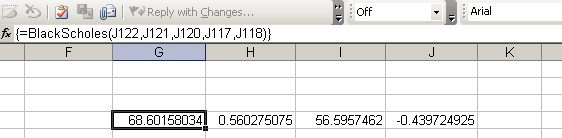

When you are finished inputing the parameters, press CTRL+SHIFT+ENTER to execute the function. Excel will populate the four cells with the calculated option values:

A sample workbook is attached:BlackScholes.xls